Restructuring paying off for Cisco Systems, if strong 1st quarter is any clue

November 2011

Cisco reported a better than expected fiscal first quarter, which CEO John Chambers attributed to the company’s restructuring paying dividends in a “limited capital spending” environment.

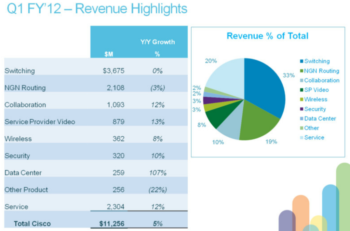

The networking giant reported first quarter earnings of $1.8 billion, or 33 cents a share, on revenue of $11.3 billion, up 4.7 percent from a year ago. Non-GAAP earnings were 43 cents a share.

Wall Street was expecting non-GAAP earnings of 39 cents a share on revenue of $11.03 billion.

In a statement, Chambers said the quarter was solid. “Even in times of limited capital spending, intelligent networks are being deployed to drive new business, revenue and consumption models, enable new customer and employee experiences, and drive efficiencies,” said Chambers.

Following restructuring changes earlier this year, Chambers cited several “foundational priorities” for Cisco that Chambers described as “key drivers of the future” of networking and the Internet. Those priorities focused on datacenters, integrated network architectures, and video strategy.

When asked during the Q&A session about how Cisco managed to grow revenue in a quarter that is supposed to be down, Chambers pointed toward several different areas where Cisco is seeing better numbers. That includes U.S. enterprise customers (up 15 percent), U.S. commercial customers (up 20 percent), and even government, which Chambers remarked was rather surprising.

Geographically, Chambers noted that Cisco saw surprising but healthy growth in Japan and that the Americas is solid at the moment. One area that could prove tumultuous for Cisco is Europe. This last quarter, Europe was stronger than anticipated with 13 percent growth.

But Chambers acknowledged that the next quarter will be a big challenge in Europe as he predicted only single digit growth.

By the numbers:

-Cisco ended the quarter with $44.4 billion in cash, investments and equivalents.

-Cash flow in the first quarter was $2.3 billion.

-Days sales outstanding were 35 days, down from 38 days in the fourth quarter and a year ago.

-Cisco generated 11.2 inventory turns in the first quarter, down from 11.8 in the fourth quarter.

-Deferred revenue in the first quarter was $4.07 billion.